If you’ve ever wondered how traders make money by simply watching price charts, then the Turtle Soup trading strategy might be a fun and easy way to get started. In this guide, we’ll break everything down like we’re teaching a kid. You’ll learn what Turtle Soup is, how it works, its success rate, and whether it’s a reliable strategy for beginners or experienced traders. And yes—we’ll keep the big words out and stick to plain English. 🐢📈

What Is Turtle Soup Trading? (Let’s Keep It Simple)

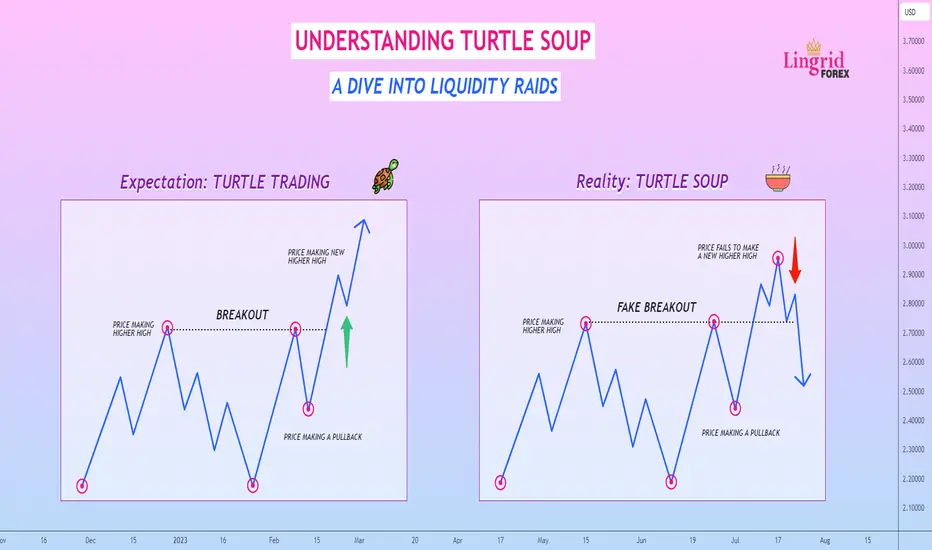

Imagine a turtle peeking out of its shell. Now imagine it quickly going back in. That’s kind of how the Turtle Soup strategy works. It’s all about faking out the market. Sometimes, a stock’s price will look like it’s breaking out of its normal range (this is called a breakout), but then it suddenly reverses direction. That reversal is where traders using Turtle Soup try to make their money.

This strategy was made popular by a trader named Linda Raschke, and it plays off the famous Turtle Trading strategy from the 1980s. Instead of following the crowd and buying when prices break out, Turtle Soup traders do the opposite—they wait for the fake-out and then trade in the opposite direction.

So, it’s a reversal strategy. It’s not about riding a big wave up; it’s about catching the moment when everyone thinks the price will keep moving but it suddenly doesn’t.

How Does Turtle Soup Actually Work?

Let’s break it down step-by-step:

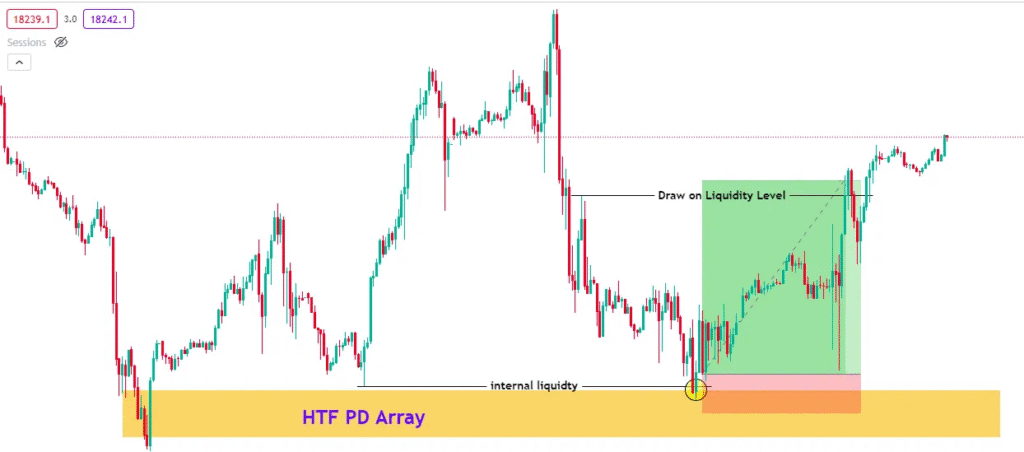

- Look for a 20-day high or low. This is the key trigger. The price must go above the previous 20-day high (or below the 20-day low).

- Watch closely for a quick reversal. The price breaks out—but only briefly. It quickly comes back inside the old range. That’s the setup.

- Enter a trade in the opposite direction. If the price faked a move upward, you sell (go short). If it faked a move downward, you buy (go long).

- Use tight stop losses. Because this is a quick move, you don’t want to risk too much. Keep your stop close.

- Take profits quickly. The goal is to catch a fast bounce, not a long trend.

This is a contrarian strategy, meaning you go against the crowd. While most people get excited during breakouts, Turtle Soup traders sit patiently, wait for the fake-out, and jump in at the perfect time.

Why Is the Success Rate So Important?

In trading, not every strategy works all the time. That’s why the success rate is super important. It helps you understand how often a strategy wins versus how often it loses. If you had to flip a coin, you’d win 50% of the time. But trading is much harder than flipping a coin.

If a strategy has a high success rate, it means more of your trades will win. But success rate alone isn’t everything. Sometimes a strategy wins 70% of the time but loses big on the 30%. So we also care about risk vs. reward.

Now, let’s break down some key parts of understanding success rate.

What’s a “Success Rate” in Trading?

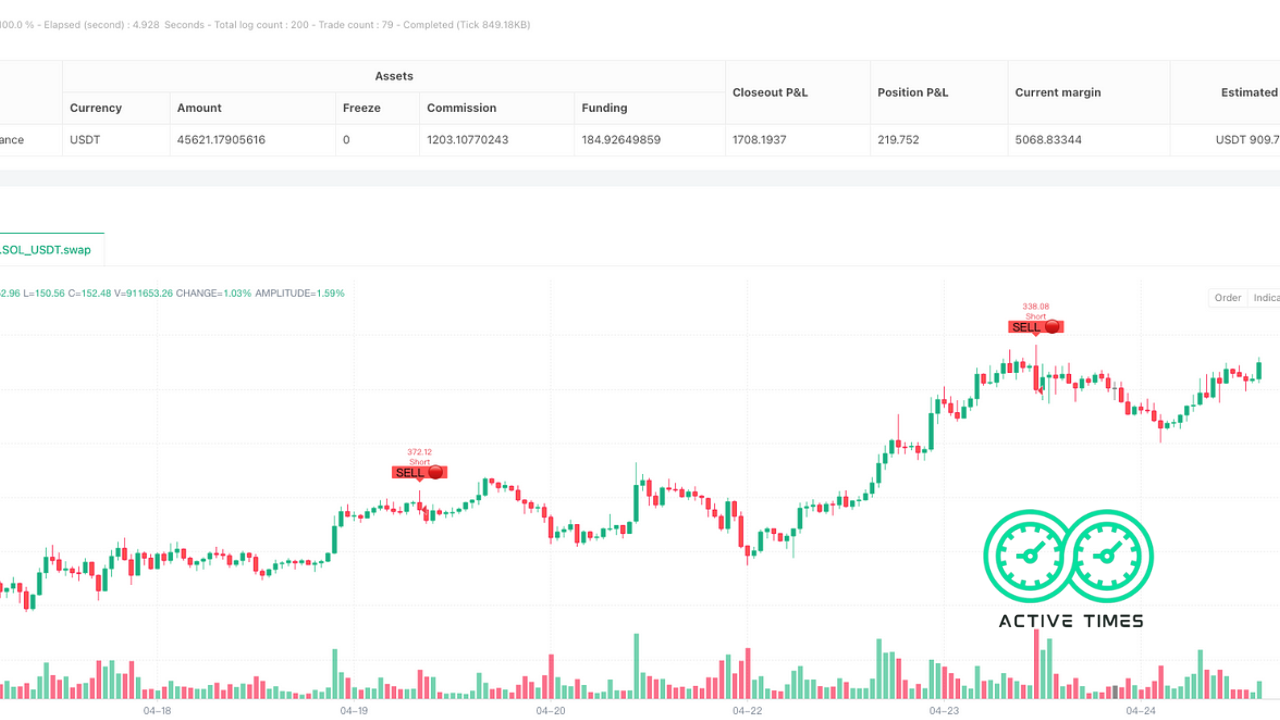

Success rate means the percentage of trades that end up profitable. If you make 100 trades and 60 of them are winners, your strategy has a 60% success rate. The Turtle Soup trading strategy usually has a success rate of around 55–65%, depending on how well it’s used and market conditions.

But remember, even with a 55% win rate, you can make money if your wins are bigger than your losses.

Is Turtle Soup Reliable for Beginners?

Yes, it can be—but only if you follow rules strictly. Turtle Soup is simple in concept but requires discipline. You must:

- Stick to the 20-day breakout rule.

- Wait for confirmation of the reversal.

- Be quick with your entries and exits.

Beginners like it because it’s clear and rule-based. There’s no guessing. You look for a breakout that fails and then take action. The challenge is emotional control—new traders often panic or hesitate.

Can You Really Make Money With It?

Yes, many traders have made consistent profits using this method. But it’s not magic. Like any trading system, it needs:

- Backtesting: Try it on old data to see how it would’ve worked.

- Discipline: Stick to the rules.

- Risk management: Never risk too much on one trade.

Success doesn’t come overnight, but with patience, you can build confidence and profit slowly over time.

What Do Real Traders Say About It?

Real traders on forums like Trade2Win, Reddit r/Daytrading, and StockTwits have mixed—but mostly positive—feedback about the Turtle Soup strategy. Many say it works best in sideways markets, where prices move in a range and breakouts tend to fail.

Some traders report win rates around 60%, with small consistent profits. Others say that during volatile news periods (like earnings or big Fed meetings), the strategy becomes less reliable.

Traders appreciate that it’s rule-based and easy to automate. You don’t need fancy indicators—just a price chart, a 20-day high/low line, and some common sense.

Pros and Cons (Good and Not-So-Good Parts)

Like all strategies, Turtle Soup has its ups and downs. Here are the highlights:

Pros:

- Easy to learn and use

- Works well in choppy, sideways markets

- Doesn’t require expensive tools or software

- Based on clear, objective rules

- Can be applied to stocks, forex, crypto, and futures

Cons:

- Not great during strong trends

- Requires fast action (you can’t hesitate)

- Success depends on discipline and timing

- May need fine-tuning for different markets

Knowing the strengths and weaknesses helps you decide when and how to use it.

When Should You Use the Turtle Soup Strategy?

Turtle Soup works best when the market is not trending strongly. That means prices aren’t moving straight up or down for days. Instead, they’re moving in a range, and breakouts often fail.

It’s also great when many traders expect a breakout—but you’re watching for a reversal instead.

Let’s look at some trading styles where Turtle Soup might fit in.

Is It Good for Day Trading?

Yes, many day traders love Turtle Soup because it gives them quick trades. If you spot a 20-day breakout during the trading day and it reverses fast, that’s your cue. You jump in, make your trade, and get out—sometimes in minutes.

It works well on 1-minute, 5-minute, or 15-minute charts, especially with volatile stocks. But you must be fast and use tight stop losses.

What About Swing Trading?

Turtle Soup also works for swing traders, who hold trades for a few days. On daily charts, look for a 20-day breakout that fails, and enter a position in the opposite direction. Hold it for a couple of days and exit when the price settles back into the previous range.

Swing traders love it because it’s predictable and low-risk, especially when combined with volume and candlestick patterns.

Tips to Get Better Results With Turtle Soup

Here are some simple tips to make your Turtle Soup trading better:

- Wait for confirmation. Don’t jump the gun. Make sure the breakout fails before entering.

- Use volume. If volume drops after a breakout, it may be a fake.

- Backtest your trades. See how it worked in the past before risking real money.

- Avoid high-impact news days. Sudden news can cause wild moves and ruin your trade.

- Keep your risk low. Only risk 1–2% of your account per trade.

- Be consistent. This strategy needs time to work. One bad trade doesn’t mean it’s broken.

Thoughts: Should You Try Turtle Soup Strategy?

If you’re a beginner or even someone with a bit of experience, the Turtle Soup strategy is definitely worth trying. It’s simple, logical, and doesn’t rely on fancy indicators. Plus, it teaches you to be patient and wait for the right moment—a valuable skill in any kind of trading.

It might not make you rich overnight, but it can be a solid stepping stone in your trading journey.

The Bottom Line

The Turtle Soup trading strategy is a clever way to profit from failed breakouts. It’s easy to understand, simple to execute, and based on logic, not hype. With a success rate of around 55–65%, it can be a powerful tool in the hands of disciplined traders.

Whether you’re a day trader, swing trader, or total newbie, Turtle Soup gives you a chance to learn price action, test patterns, and build confidence with real results.

Start slow, use a demo account, and practice watching 20-day highs and lows. You might be surprised at how often breakouts fail—and how often Turtle Soup can help you catch them.