Coyyn.com digital banking is a smart, secure, and simple way to manage your money from anywhere in the United States. Whether you’re paying bills, saving for the future, or sending money to family, Coyyn.com offers fast and safe tools that make digital banking easier than ever before for everyone.

What Is Coyyn.com Digital Banking?

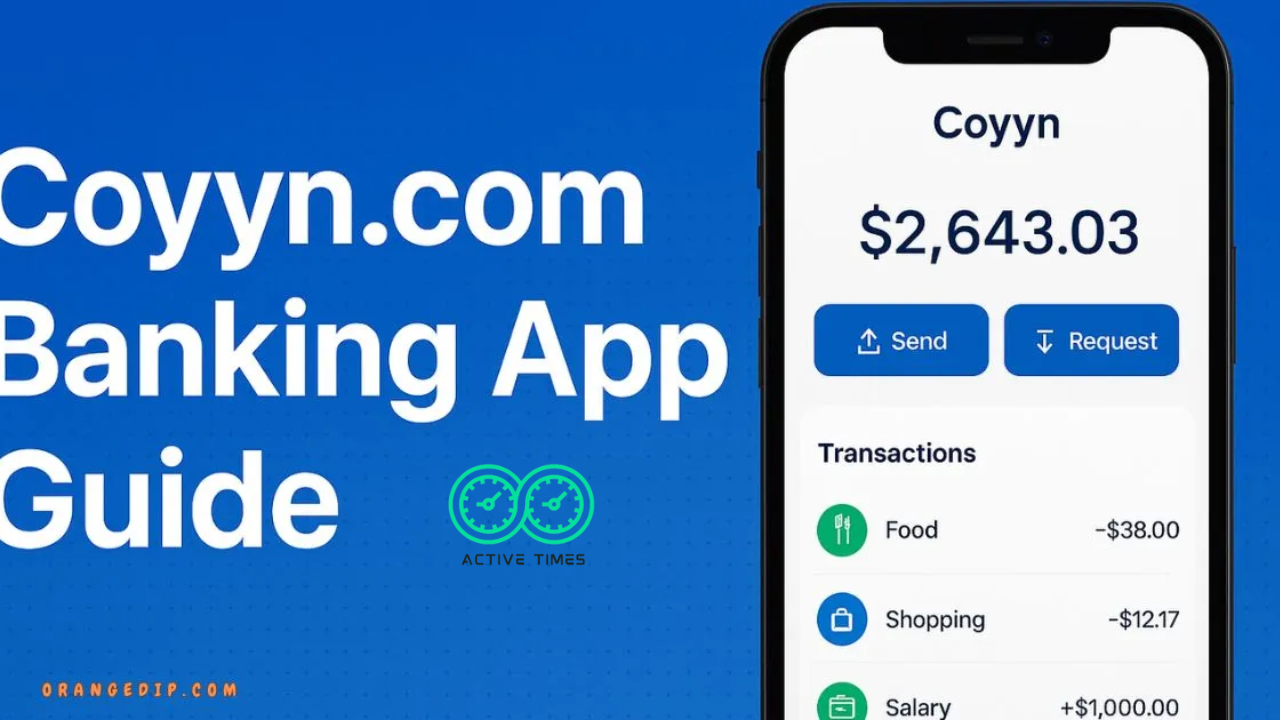

Coyyn.com digital banking is an easy-to-use financial platform designed to give users full access to their money online. It replaces the need to go to a traditional bank by offering all the essential banking services through your smartphone or computer. With Coyyn.com, users can open an account, receive or send money, view balances, pay bills, and manage their savings completely online. This digital banking solution is perfect for people who want a simpler, faster, and more modern way to handle their personal finances in the United States. It focuses on making digital finance accessible to all age groups, including teens, families, freelancers, and small business owners.

Unlike physical banks that require you to fill out paperwork, wait in line, or schedule appointments, Coyyn.com is paperless, user-friendly, and available 24/7. It also eliminates the traditional banking fees you often find with legacy institutions. Users who are familiar with other digital banks like Chime, Varo, or Current will find Coyyn.com to be a similar but more refined experience tailored to American banking needs. This platform uses secure encryption, fraud detection, and real-time alerts to keep your financial activity safe and monitored. From budgeting tools to account tracking, Coyyn.com covers every part of digital banking in one place.

Why People Choose Digital Banks Like Coyyn.com

People across the United States are shifting to digital banks like Coyyn.com because of the unmatched convenience and cost savings. Traditional banks often charge high fees for account maintenance, ATM withdrawals, and overdrafts. But Coyyn.com avoids these common pitfalls by offering low-fee or no-fee banking, which makes it ideal for families, students, and freelancers. Another key reason why people prefer Coyyn.com is that it saves time. You no longer need to stand in line at the bank or wait for business hours to get access to your funds. Everything you need can be done directly through your mobile device or computer. Users can also enjoy real-time notifications for every transaction, helping them stay on top of spending and avoid unexpected charges.

Another major reason people choose Coyyn.com is that it integrates smoothly with daily life. Whether you’re paying rent, shopping online, or splitting dinner with friends, you can handle it all with just a few taps. Coyyn.com has made it easier than ever to manage money digitally. Plus, it appeals to tech-savvy users who want speed, automation, and real-time financial control. Since the platform also supports direct deposit, mobile check deposit, and peer-to-peer transfers, it meets the expectations of both younger and older users who are looking for safe online financial tools.

How to Open an Account on Coyyn.com

Opening a digital bank account on Coyyn.com is incredibly simple and can be completed in just a few minutes. First, visit the official website or download the mobile app from the App Store or Google Play. Then, you’ll be asked to provide some basic personal information, like your full name, email address, phone number, and Social Security number for identity verification. After that, you’ll set up a secure password and select your account type. There are no physical documents to sign or scan, making the entire process smooth and paperless. Once your identity is confirmed, your account is ready to go, and you can start using Coyyn.com digital banking features immediately.

No Need to Visit a Bank

One of the biggest advantages of Coyyn.com digital banking is that there is no need to step into a physical bank branch. Everything is handled online, so you can open and manage your account from the comfort of your home or while on the go. This is especially useful for people who live in rural areas or have busy schedules and can’t find the time to visit a traditional bank. Coyyn.com brings banking to your fingertips, anytime and anywhere in the United States.

Paperless and Fast Setup

Coyyn.com’s signup process is completely paperless, making it fast and environmentally friendly. You don’t need to print, fax, or mail any documents. All the verification steps are done securely online, which helps you get started in less than 10 minutes. The platform is designed to be easy for everyone to use, even if you’re not familiar with online banking. Its guided setup and helpful tips make account opening quick and stress-free.

Instant Access to Your Money

As soon as your account is active, you can deposit money, receive direct deposits, or even transfer funds from your existing bank account. You don’t need to wait for days to start using your money. Coyyn.com gives you instant access to your funds, and with features like real-time balance updates and transaction alerts, you’ll always know where your money is and how it’s being used. This makes it a great option for people who need fast access to their cash without waiting for bank hours.

Key Features of Coyyn.com Digital Banking

Coyyn.com offers a wide range of digital banking features designed to make your financial life easier and more organized. One of the standout features is real-time transaction notifications, which help you track spending instantly and spot any suspicious activity. The app also supports mobile check deposits, direct deposits, bill payments, and peer-to-peer transfers. You can even schedule payments or set up automatic savings to meet your financial goals. For added security, Coyyn.com includes biometric login options such as fingerprint or facial recognition, plus two-factor authentication to protect your account from unauthorized access.

Another powerful feature is its budgeting tools. Coyyn.com helps you track your income and spending by category, giving you clear insights into where your money goes each month. This makes it easier to create savings goals, avoid overspending, and stay on top of bills. Additionally, there are no hidden fees or surprise charges, which is a common issue with traditional banks. Everything is transparent, and you can view your full financial history in the app. The user interface is clean and simple, making it easy for users of all ages to navigate their accounts and perform tasks quickly.

Is Coyyn.com Safe to Use?

Yes, Coyyn.com digital banking is extremely safe to use. The platform uses advanced encryption technologies and fraud detection systems to protect your personal and financial information. Every transaction is monitored in real time to prevent unauthorized activity. If anything suspicious is detected, you are immediately notified through the app or email so you can take action quickly. Coyyn.com also requires multi-layer authentication and login alerts, adding an extra layer of security to your account.

All data transmitted between your device and Coyyn.com’s servers is encrypted using bank-grade SSL technology. In addition, the platform complies with U.S. financial regulations and security standards, ensuring that your money is held securely and your privacy is protected. These features make Coyyn.com one of the safest digital banking platforms for users across the United States. Whether you’re new to digital banking or switching from another provider, Coyyn.com gives you the peace of mind you need to trust it with your finances.

Benefits of Using Coyyn.com in the USA

Coyyn.com digital banking brings many benefits to users living in the United States. One of the biggest advantages is the nationwide accessibility. Whether you’re in New York, Texas, or California, Coyyn.com gives you the same banking experience from any location. The platform is mobile-first and cloud-based, which means it works just as well in small towns as it does in big cities. There’s no need to search for a nearby branch or ATM because everything you need is available in the app or online.

Works Nationwide

Coyyn.com is built for people across the country. It doesn’t matter where you live or travel — you can manage your money from anywhere in the United States. If you move to a new state or travel for work, your banking experience stays the same. This is a huge advantage compared to local banks that only operate in certain regions. You’ll always have full access to your funds, with no disruption to your banking services.

Easy for Families and Teens

Coyyn.com is a great choice for families looking to teach teens about money. Parents can help set up accounts for their children, monitor spending, and even transfer funds instantly. For teens, it’s an excellent introduction to money management in a digital world. The platform’s user-friendly interface and strong parental controls make it safe and educational. Families can also use Coyyn.com for household budgeting, shared expenses, and managing allowances — all in one app.

Coyyn.com vs. Regular Banks

Compared to regular banks, Coyyn.com offers faster service, lower fees, and more flexibility. Traditional banks often have limited hours, require in-person visits, and charge for everything from paper statements to account maintenance. Coyyn.com eliminates those pain points by offering a fully digital experience with no hidden fees. Transactions are processed faster, account updates happen in real time, and customer support is always available online. This makes it a smart alternative to regular banks, especially for younger users and people who prefer mobile-first services.

How to Use the Mobile App

The Coyyn.com mobile app is designed to be your all-in-one financial hub. After downloading it from the App Store or Google Play, log in using your secure credentials. From there, you can view your balance, check transactions, transfer money, pay bills, and deposit checks. The app is optimized for both iPhone and Android and includes built-in security like fingerprint and facial recognition for fast and safe login. You can also set up savings goals, track spending, and get real-time alerts every time money enters or leaves your account. The app is lightweight, fast, and works on all major devices, giving you full control over your money anytime, anywhere.

The Bottom Line

Coyyn.com digital banking is a smart, secure, and easy way to manage your money online. With features like instant access, paperless setup, nationwide service, and strong security, it’s a great alternative to traditional banking. Whether you’re opening your first bank account, switching from another provider, or looking for a better way to manage your family’s money, Coyyn.com gives you the tools you need. It’s simple enough for a 10-year-old to understand and powerful enough for adults to trust. In a world that’s going more digital every day, Coyyn.com is the future of banking — today.