Tokenizasyon may sound complicated, but it’s actually a simple concept that protects your sensitive information. Whether you’re shopping online, using your credit card at a store, or even logging in to an app, tokenization is quietly working in the background to keep your data safe. This guide will break it down step by step in a way anyone can understand.

What Is Tokenizasyon?

Tokenizasyon is a security process that replaces sensitive information, like your credit card number or personal ID, with a random string of characters called a “token.” This token has no meaningful value on its own. Even if someone steals it, they cannot use it to get your original data.

Think of tokenization like using poker chips at a casino. Instead of carrying cash everywhere, you exchange your money for chips. The chips represent your money inside the casino but are useless outside of it. In the same way, a token represents your sensitive data in a secure system but is meaningless outside of that system.

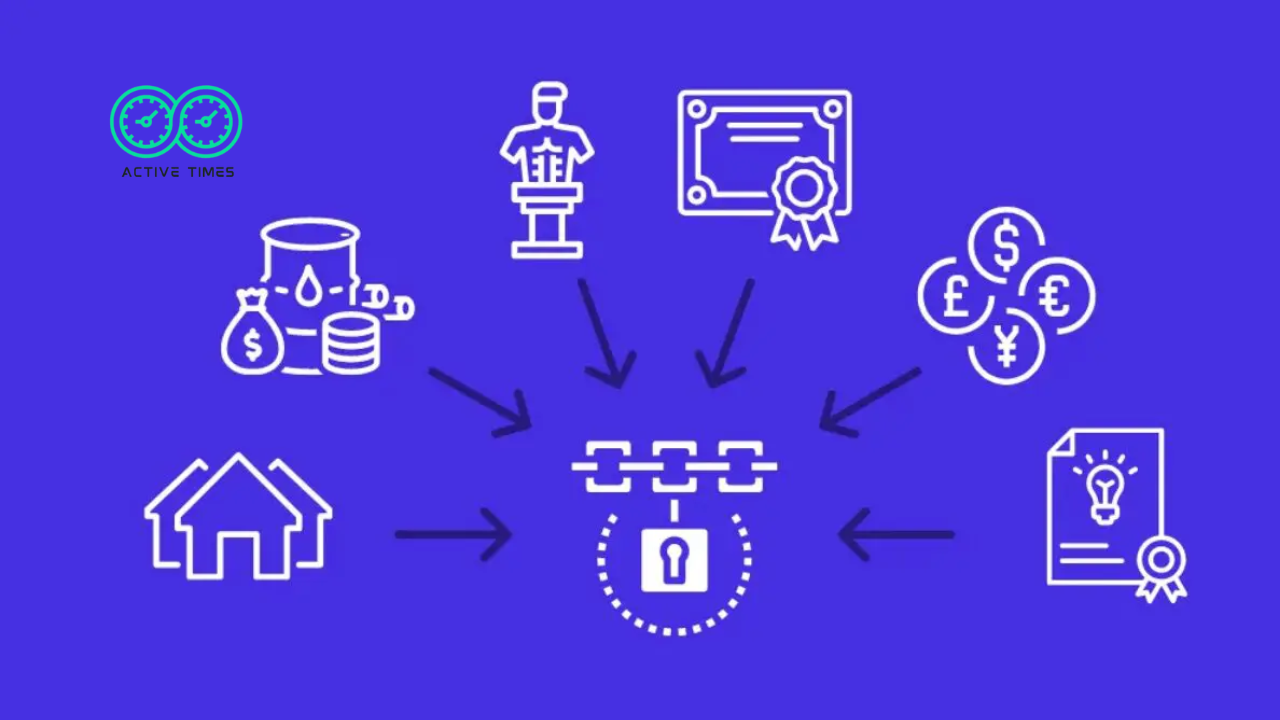

This concept is widely used today in the digital world to protect payment information, medical records, personal IDs, and more. It’s one of the strongest shields against cyber theft and data breaches.

Why Do We Need Tokenizasyon?

Every year, millions of people suffer because of stolen data. Hackers are constantly looking for credit card numbers, social security numbers, and passwords. Once they get access, they can drain bank accounts, commit identity theft, and cause damage that takes years to fix.

This is where tokenization becomes essential. Instead of storing real sensitive data in databases (which can be hacked), companies store only tokens. If a hacker breaks into the database, they only find meaningless tokens, not real information. This greatly reduces the risk of data theft.

Think of it like keeping your real jewels in a secure vault while displaying fake ones in your home. Even if someone breaks in, they only get the fake jewelry.

How Does Tokenizasyon Work?

At its core, tokenization works by substituting real sensitive data with random, unique tokens. When you enter your credit card number into a payment app, the system sends it to a secure tokenization server. This server creates a token – a random string like “X9G4-2P1L-7H6Q” – and sends it back.

The token is stored in the app or database, while your real card number is kept safe in a highly protected system called a “vault.” Anytime a transaction needs the original card number, the system retrieves it securely using the token.

The most important thing to remember: tokens cannot be reversed into the original data without access to the secure vault.

Real Example of Tokenizasyon

Imagine you use Apple Pay to buy coffee. When you tap your phone, Apple doesn’t send your real credit card number to the coffee shop. Instead, it sends a token. The shop processes the token like a credit card number, but it never sees your real account details. Even if their system gets hacked, your information stays safe.

Tokenization vs Encryption (What’s Different?)

Many people confuse tokenization with encryption, but they’re different. Encryption scrambles data into unreadable code that can be reversed with a decryption key. Tokenization, on the other hand, replaces the data completely with a token. There is no mathematical formula to reverse it.

Key differences:

- Encryption can be broken if hackers get the key.

- Tokenization doesn’t have a key. Only the secure server knows the mapping.

- Tokenization is often safer for protecting stored data.

Is Tokenizasyon Safe?

Yes, tokenization is considered extremely safe. Because tokens don’t have any exploitable value, stealing them is pointless. Even if hackers steal millions of tokens, they can’t turn them into credit card numbers or personal data.

Of course, the security of tokenization depends on the system managing the original data. If the secure vault is breached, the protection is compromised. But with modern security standards, such breaches are rare.

Types of Tokenizasyon

There are different types of tokenization depending on how and where it’s used:

- Payment Tokenization – Used by payment processors like Visa or PayPal to protect cardholder data.

- Vaulted Tokenization – Stores the link between the token and real data in a secure “vault.”

- Vaultless Tokenization – Generates tokens algorithmically without a vault, used for high-speed systems.

- Format-Preserving Tokenization – Keeps the token’s format similar to the original data, useful in systems that require specific data formats.

Each type is designed for different security needs and industries.

Tokenizasyon in Everyday Life

You may not realize it, but tokenization is all around you.

When you save your credit card on Amazon, they don’t store your actual number. Instead, they use a token. Ride-sharing apps like Uber and Lyft also use tokenization to protect payment information. Even when you use hotel keycards or loyalty cards, tokenization might be at work behind the scenes.

Healthcare systems use tokenization to protect patient records. Banks use it to secure transactions. Almost every modern digital service relies on tokenization to make your data safer.

Benefits of Tokenizasyon

Tokenization comes with several key benefits that make it a favorite for businesses and users alike.

Safer Payments

Tokenization prevents sensitive card details from being exposed during transactions. Even if a hacker intercepts data, they only get a useless token instead of your real account number. This greatly reduces fraud in online and mobile payments.

Lower Risk of Data Breaches

Companies that use tokenization don’t store real sensitive data in their databases. So even if hackers break in, they won’t find anything valuable. This minimizes the financial and reputational damage caused by data breaches.

Easy for Businesses

Implementing tokenization can be simpler and more cost-effective than encryption, especially for businesses handling large volumes of transactions. It also helps them comply with strict regulations like PCI DSS (Payment Card Industry Data Security Standard).

Challenges of Tokenizasyon

While tokenization is powerful, it’s not perfect. Businesses must manage the secure vault properly to avoid a single point of failure. Vaultless tokenization solves some problems but can be complex to implement. Also, tokenization requires integration with existing systems, which may take time and investment.

Despite these challenges, the benefits far outweigh the risks for most organizations.

The Bottom Line

Tokenizasyon is one of the most effective ways to protect sensitive information in today’s digital world. By replacing real data with random tokens, it makes life much harder for hackers and keeps your personal and financial details safe.

Whether you’re shopping online, using mobile apps, or sharing information with healthcare providers, tokenization is working silently behind the scenes. As more businesses adopt this technology, we can all enjoy safer and more secure digital experiences.